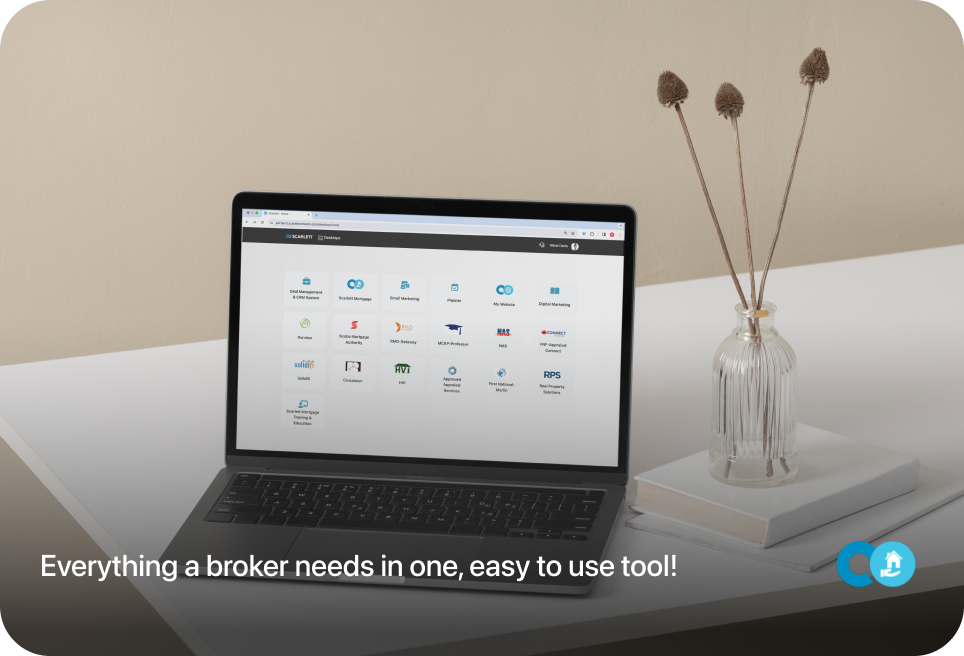

Stop using

multiple systems

Book a demo

With Scarlett, you can eliminate the need for costly monthly subscriptions to multiple systems and consolidate all your mortgage tools into one with our cloud-based mortgage software, enabling better management of your business from start to finish.

-

$42B

Mortgage volume through Scarlett Mortgage.

-

65%

Of the industry’s payroll and compliance transactions are processed through Scarlett Network.

-

Winner of Best

Product AwardScarlett Network’s Mortgage Appraisal software was recognized as a winner in both 2023 and 2024.

Scarlett

Mortgage

- Stop Using Multiple Systems

- Make Sure Every Client Gets Your Best

- Run Your Business Like a Pro

- Stay On Top Of Important Dates & Deadlines

- Gather, Create & Organize Documents In One Place

- Identify Untapped Revenue Streams

- Your Business Wherever You Are

- Largest Partner Network

- API Ready & Other Integrations

Scarlett

Pay

- Save Time, Save Money

- Increased Productivity

- Commission Structures That Work For Your Business

- Pay & Collect

- In-Depth Business Performance Analysis

- Stay On Top Of Your Taxes

- Stay Compliant

- Upgrade & Centralize Compliance Operations

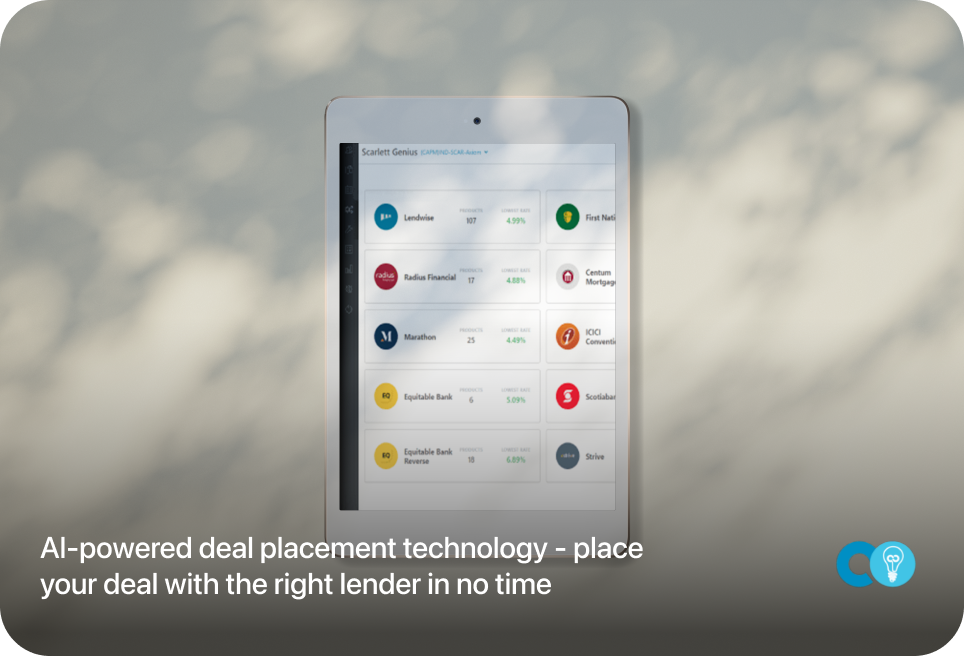

Scarlett

Genius

- Searchable Products & Rates

- Lender Guidelines at your Fingertips

- In-Deal Placement Suggestions

- Time Back for What Matters

- Improve Your Funding Ratios

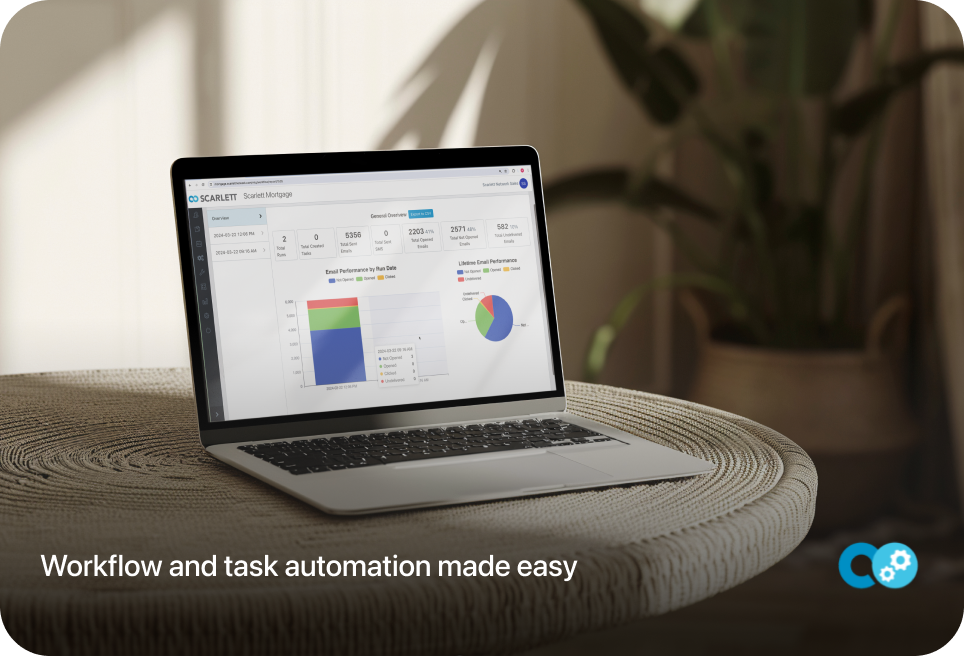

Scarlett CRM

& Automation

- Simplicity and Control

- Efficiency and time management

- Complex data mining made easy

- Lead management

- Deal and marketing automation (Email, SMS)

- Lead and deal flow management

- Task management

- Email, contact and task synchronization

Scarlett

Underwriting

- End to End Loan Underwriting

- Loan Management System

- Integration with all origination platforms (Filogix, Filogix Pro, Scarlett, Newton)

- Integration with Credit Bureau services

- Forms Generation

- Decisioning and Adjudication

- Configurable Business Rules

- Broker portal

Scarlett

Websites

- Your Site, Your Brand

- The Best Resources for Your Clients

- Easy to Use Online Mortgage Application

- More Visits = More Leads

- Grow Your Social Network

“Scarlett has been a game changer

for me and my business.

The simple, concise interface makes inputting applications quick and seamless. The online mortgage application brings this a step further ensuring that the applicants provide all the necessary information in a simple process that then makes my job even easier as I just have to ensure all the information has been added and submit the application. This along with Docusign, an integrated CRM, and document collection saved within the application, so that I don’t have to search for emails to find the documents, makes Scarlett the unrivalled choice for me.”

Fulvio Noce

Broker

Assured Mortgage Services

“We leveraged Scarlett’s CRM and Automation to

build our own unique touch program for all our agents.

Scarlett Mortgage offers a library of pre-build automations, and with support from their team and Centum… we added our own custom video touchpoints. In total, we have over 30 video and text-based automations available to our agents for reaching clients along their mortgage journey, with no setup or configuration required for the agents!”

David Warren

Co-Owner

Referral Mortgages

“In January I finally made

the switch to Scarlett.

I had tried Filogix and Finmo, but they were missing a CRM functionality. For 3 years I have worked without one. Technology is not my strength and after 20 years at BMO this was a big change for me. The busier I got, the more I realized the importance of a CRM. Also having the ease of collecting documents from my clients. While I have only being using it for a month, I have to say I cannot wait to learn everything Scarlett has to offer to really help with my time management.”

Lorie Burke

Mortgage Agent

Centum Financial Services